Introduction

Abel Boreto was tired of waiting. Every time he visited his hometown in rural Kenya, the internet would crawl to a halt, buffering endlessly during important work calls. His mobile data plan from Safaricom was expensive and unreliable. Then he discovered something that changed everything: satellite internet beaming directly from space to his rooftop.

“Safaricom was quite on the high side and the internet wasn’t even reliable,” Abel told reporters in 2024. “I decided to try out Starlink, which is more affordable ($10 per month for 50GB) to subscribe and use in the long term.”

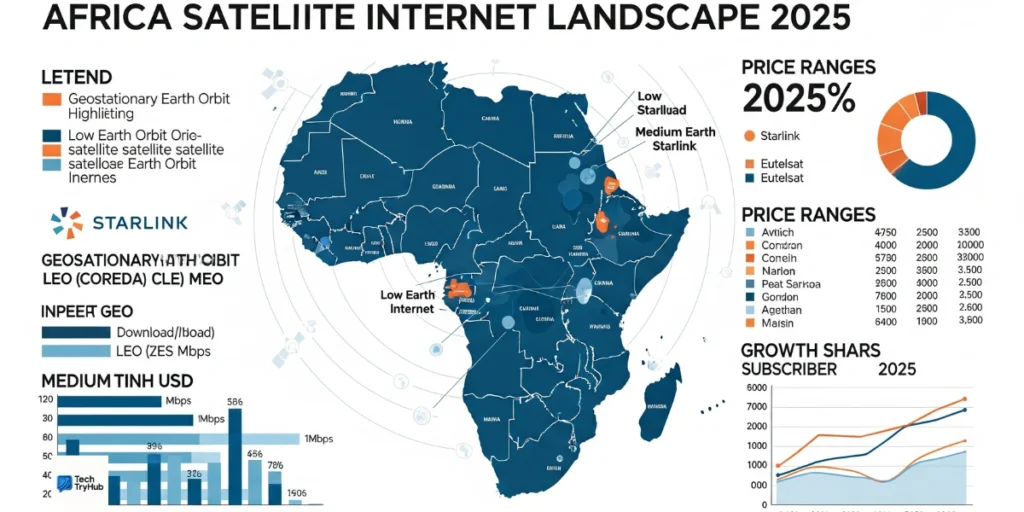

Abel’s story isn’t unique. Across Africa, millions are discovering that satellite internet once considered too expensive and slow has become a lifeline. But here’s what most people don’t realize: there are actually three types of satellites orbiting above us, each working differently. The revolution happening right now involves all of them.

What Makes Satellite Internet Different in Africa?

Africa faces a connectivity crisis that traditional infrastructure can’t solve alone. As of 2024, only 39% of Africa’s population has internet access compared to the global average of 60%. That’s not just a statistic; it’s millions of students unable to access online education, farmers missing weather updates, and businesses losing customers.

The problem isn’t lack of demand. It’s geography.

Laying fiber optic cables across vast deserts, dense forests, and remote villages costs astronomical amounts. Building cell towers in areas where electricity itself is scarce makes no economic sense to traditional telecom companies. Sub-Saharan Africa has the lowest internet penetration globally at just 22%, with 28% of the world’s unconnected population living on the continent.Geo sattelite internet africa

Satellite internet bypasses all of this. No digging. No towers. Just a dish pointed at the sky.

The Three Types of Satellites Serving Africa

Not all satellite internet works the same way. Understanding the difference matters because it affects your speed, cost, and experience.

GEO (Geostationary Earth Orbit) Satellites These giants orbit 35,786 kilometers above Earth, staying fixed over one spot. Companies like Eutelsat, SES, and YahClick have used GEO satellites for decades to provide internet across Africa. The advantage? One satellite can cover massive areas. The downside? That distance creates lag sometimes half a second or more.

Think of it like shouting across a canyon. Your voice reaches the other side, but there’s a delay.

LEO (Low Earth Orbit) Satellites LEO satellites orbit as low as 1,000 kilometers above Earth, drastically reducing latency and delivering speeds up to 300 Mbps. Starlink, OneWeb, and Amazon’s upcoming Project Kuiper all use LEO constellations. Because they’re closer, they’re faster. But you need thousands of them orbiting constantly to maintain coverage.

MEO (Medium Earth Orbit) Satellites These sit in the middle, around 8,000-20,000 kilometers up. SES’s O3b constellation uses MEO satellites to serve business and government clients across Africa. They balance coverage area with acceptable latency not as fast as LEO, but covering more ground than you’d think.

The Starlink Effect: How One Company Disrupted an Entire Market

When Starlink launched in Kenya in July 2023, something unexpected happened. Within one year, Starlink became Kenya’s tenth-largest internet service provider with over 8,000 subscribers by June 2024. That growth rate was so explosive that the company had to pause new subscriptions in major cities due to network overload.

But Kenya wasn’t even Starlink’s first African market.

Nigeria became Starlink’s first African market in January 2023, and by the third quarter of 2024, it had captured over 65,500 users, ranking second among all internet service providers. At current growth rates, analysts predict Starlink will become Nigeria’s top ISP by mid-2026.

Here’s what nobody saw coming: In at least five African countries Kenya, Ghana, Zimbabwe, Mozambique, and Cape Verde Starlink’s monthly subscription is actually cheaper than the leading local internet provider.

Let that sink in. A space-based internet service from an American company is undercutting local providers who have infrastructure already on the ground.

The Pricing Reality Across Africa

Starlink’s pricing varies dramatically by country, reflecting local economic conditions and competition:

| Country | Monthly Cost | Status |

|---|---|---|

| Kenya | $10-15 | Paused in cities |

| Nigeria | ~$45 | Rapidly growing |

| Ghana | $28-34 | Available |

| Zimbabwe | $28-34 | Recently approved |

| Mozambique | $28-34 | Available |

| South Africa | $30-40 | Expanding |

| Eswatini | $50 | Available |

The upfront hardware cost ranges from $178 for a Starlink Mini in Kenya to $381 for a Standard Actuated kit in Nigeria. Kenya even introduced a rental option at $15 per month to make the hardware more accessible.

But here’s the catch: Starlink doesn’t have fixed rates. The company explicitly states it “may adjust prices over time to reflect market conditions resulting in a decrease or increase of the monthly service plan cost.” In October 2024, Nigeria saw prices jump from ₦38,000 to ₦75,000, nearly doubling overnight.

How Traditional Providers Are Fighting Back

Local internet companies didn’t take this disruption lying down.

When Starlink increased prices in Nigeria, local operators accused the regulator of applying double standards by ignoring their requests for tariff reviews. The Nigerian Communications Commission eventually granted local providers a 50% tariff increase in January 2025, but the damage to customer perception had already been done.

In Kenya, Safaricom the dominant telecom giant responded aggressively. The company lowered prices and increased internet speeds to compete, while its parent company Vodacom announced a partnership with AST SpaceMobile to provide satellite internet in Europe and Africa.

The irony? AST SpaceMobile launched its satellites using SpaceX rockets the same company behind Starlink.

Gbenga Adebayo, chairman of Nigeria’s Association of Licensed Telecommunications Operators, pointed out the fundamental unfairness: “You can’t compare Starlink with local companies because they don’t have to set up local capacity, nor hire and set up an office.” Local providers face multiple taxes, right-of-way permits, infrastructure vandalism, and rising foreign exchange costs that satellite companies simply don’t deal with.Geo sattelite internet africa

The GEO Satellite Players Aren’t Dead Yet

While LEO satellites grab headlines, traditional GEO satellite providers are evolving, not disappearing.

Eutelsat’s Konnect satellite operating at 7°E represents a new generation of High Throughput Satellites specifically designed for Africa. Companies like iSAT Africa leverage this platform to provide enterprise-grade connectivity across multiple frequency bands (C-band, Ku-band, and Ka-band) with dedicated SCPC and TDM/TDMA platforms.

These GEO services target a different market: banks needing VSAT connections for ATMs, government installations requiring secure communications, and businesses wanting guaranteed bandwidth. The latency matters less for these use cases, and the reliability of a single satellite covering vast areas offers advantages LEO constellations can’t match.

SES’s O3b MEO constellation has been serving the Democratic Republic of Congo and other challenging markets for years, providing mobile network operators with backhaul connectivity in areas where fiber doesn’t reach.

Real-World Impact: Beyond Just Internet Speed

The transformation satellite internet brings goes deeper than faster Netflix streaming.

Education

Kenya’s ICT ministry partnered with UNICEF to set aside $140 million to connect 1,000 primary schools to the internet. Similar initiatives are rolling out across Tanzania, Mali, Guinea, Burkina Faso, and other countries. Rwanda’s Icyerekezo satellite project, launched in partnership with OneWeb in February 2019, connected Groupe Secondaire St Pierre Nkombo school on Nkombo Island, a location previously cut off from reliable internet.Geo sattelite internet africa

For students in these remote schools, satellite internet isn’t just educational it’s transformative. They can access Khan Academy, connect with students in other countries, and develop digital skills that were simply impossible before.

Healthcare

Rwanda pioneered using drones to transport blood and medical supplies to remote clinics in 2016. That requires reliable internet connectivity for coordination. Tanzania’s Airtel provides free messaging services about infant care to pregnant women and new mothers. South Africa’s MomConnect platform connects a national pregnancy registry with a help desk for questions and feedback.

Nigeria’s NigComSat agency partnered with the Universal Service Provision Fund to connect rural schools via VSAT, GEO, and MEO systems, with installations in states like Kaduna and Cross River, while also supporting telemedicine in remote clinics.

Business and Agriculture

Olumide Lewis, a Lagos-based tech worker, explained the practical impact: “For me, it was less speed and more concern about constant internet blackouts during meetings. Since we bought our Starlink, we have had some peace of mind. Geo sattelite internet africa we don’t spend our time thinking about the bad internet again because everything just works.”

Farmers can now access real-time weather forecasts, market prices, and agricultural advice. Small businesses in rural areas can process digital payments and reach customers online. Africa Mobile Network reported a 45% increase in internet traffic across more than 100 rural base stations using Starlink’s LEO constellation in Nigeria, highlighting improved productivity for SMEs engaging in digital Gommerce.geo sattelite internet africa

The Regulatory Puzzle: Why Some Countries Still Don’t Have Access

Despite the technology being available, many African countries still don’t allow satellite internet services. The reasons are complex and often political.

Zimbabwe approved Starlink’s operation in 2024, anticipating enhanced rural internet infrastructure. Chad approved Starlink in November 2024 to strengthen national connectivity, particularly in areas lacking fiber optics. But other countries drag their feet.

Namibia held discussions with SpaceX but faced regulatory hurdles that delayed deployment. Morocco is set to give regulatory approval to OneWeb and Starlink by 2025, years after the technology became available.

The concerns are threefold:

Economic Protection Local telecom companies employ thousands of people. Allowing foreign satellite providers threatens jobs and local investment. Safaricom in Kenya raised precisely these concerns, asking regulators to block satellite ISPs without local partners.

Data Sovereignty Nigerian officials noted that critical government institutions avoid using Starlink’s network because “the military is not meant to ride on Starlink because its data would go to the United States, which can easily mine and cook the data”.

This isn’t paranoia it’s geopolitics. When your country’s internet traffic routes through another nation’s satellites, who controls that data? Who can shut it off?

Revenue Loss Governments earn significant fees from local telecom operators through licensing, spectrum auctions, and taxes. Satellite operators often structure their businesses to minimize these payments, operating from their home countries while serving African customers.

What the Future Holds: 2025 and Beyond

The satellite internet race in Africa is accelerating, not slowing down.

Amazon’s Project Kuiper Amazon’s Project Kuiper launched 27 satellites into low Earth orbit in April 2025, part of a plan to deploy more than 3,200 LEO satellites. The company has already partnered with Vodacom to use these satellites as orbiting cell towers to connect smartphones directly.

OneWeb’s Expansion OneWeb, now part of Eutelsat Group after a merger, achieved 90% global coverage by mid-2024. Paratus Africa, a leading OneWeb distribution partner, offers speeds up to 195 Mbps down and 32 Mbps up with latency lower than 70 milliseconds. The company is actively partnering with distributors across 37 African countries.

National Satellite Programs South Africa is advancing plans to launch its own geostationary satellite within the next five to seven years to improve internet access and reduce reliance on private providers. This follows the model of Nigeria, Algeria, Egypt, and Angola, which already operate their own national satellite systems.

Direct-to-Cell Technology The next frontier isn’t satellite internet dishes at all. MTN South Africa collaborated with Lynk Global in March 2025 to make Africa’s first satellite voice call using a standard mobile phone no special equipment required. If this technology scales, your regular smartphone could connect directly to satellites when cell towers aren’t available.

Key Takeaways

Three satellite types serve Africa: GEO satellites offer wide coverage with higher latency, LEO satellites deliver faster speeds with lower latency, and MEO satellites balance both approaches.

Pricing varies dramatically: From $10/month in Kenya to $50/month in Eswatini, with hardware costs between $178-$381 depending on the country and equipment type.

Market disruption is real: Starlink has forced traditional providers to lower prices and improve speeds across Kenya, Nigeria, and other markets.

Regulatory barriers remain significant: Data sovereignty concerns, economic protection, and licensing delays prevent many countries from accessing satellite internet services.

Impact goes beyond connectivity: Education, healthcare, agriculture, and small businesses are being transformed in previously unconnected areas.

Making the Decision: Is Satellite Internet Right for You?

The answer depends entirely on your situation.

Choose satellite internet if:

- You live in a rural or remote area with poor fiber/mobile coverage

- You need reliable connectivity for work or business

- Traditional ISPs don’t serve your location

- You can afford the upfront hardware cost

- You’re willing to accept potential price increases

Stick with traditional providers if:

- You live in a city with good fiber coverage

- Price stability matters more than cutting-edge technology

- You prefer supporting local companies

- Data sovereignty concerns matter to you

- The upfront hardware cost is prohibitive

Consider GEO satellite services if:

- You need enterprise-grade reliability

- Your use case doesn’t require ultra-low latency

- You’re operating in a country where LEO providers aren’t licensed

- You need specialized business services (VSAT for ATMs, dedicated bandwidth, etc.)

The reality is that Africa needs all of these solutions working together. Researchers from MIT predict that satellites are likely to bring more people online in Africa in the next five years due to the challenges of terrestrial-based systems.

Conclusion: (Geo sattelite internet africa)

Satellite internet has moved from luxury to necessity across Africa. Whether you’re choosing GEO for enterprise reliability or LEO for home use, space-based connectivity now reaches places fiber never will.

The numbers tell the story: from 8,000 Kenyan subscribers to 65,500 Nigerian users in under two years, adoption is accelerating. Competition is driving prices down and forcing traditional providers to finally innovate.

For Abel in rural Kenya, it’s simple. His internet works. No buffering. No excuses. Just reliable connectivity that lets him work from anywhere.

That’s what matters most turning connection into opportunity, regardless of where you live.

Using satellite internet in Africa? Drop your experience in the comments.

FAQ: (Geo sattelite internet africa)

Q1. What is GEO satellite internet and how does it work in Africa?

GEO satellites orbit 35,786 km above the equator in a fixed position, covering massive areas of Africa. They use C-band, Ku-band, and Ka-band frequencies for enterprise and broadcast services, though with higher latency than newer LEO systems.

Q2. Is Starlink available in my African country?

Starlink operates in 16+ countries including Nigeria, Kenya, Rwanda, and Zimbabwe as of 2025. Availability varies by city, with some markets paused. Check their official website for your location.

Q3. How much does satellite internet cost in Africa?

Monthly plans range from $10 (Kenya) to $50 (Eswatini), plus hardware costs of $178-$381. Traditional GEO providers charge $28-45 monthly with varying equipment fees.

Q4. What’s the difference between Starlink and traditional satellite internet?

Starlink’s LEO satellites orbit at 550 km with 20-40ms latency and 50-300 Mbps speeds. Traditional GEO satellites sit at 35,786 km with 600ms latency but offer wider coverage and proven enterprise reliability.

Q5. Can I use satellite internet for video calls and online gaming?

LEO services like Starlink handle video calls and most online activities well. GEO satellite internet works for video calls but struggles with real-time gaming due to 500-800ms latency.

Q6. Will satellite internet replace fiber and mobile networks in Africa?

No, it complements them. Satellite excels in remote areas where fiber is too expensive, while cities will stick with fiber for better value. The future is hybrid connectivity.

Q7. Are there security concerns with using foreign satellite internet services?

Yes. Traffic routes through foreign-controlled satellites raise data sovereignty issues. Nigeria’s military and critical installations avoid these services, preferring national satellite systems for security.