Introduction: crypto-legacy.app Honest Review & Safety Guide

Have you ever clicked a shiny crypto site and felt that little twinge this looks too good to be true? That happened to me last month when I found crypto-legacy.app while researching automated trading tools. I dug in, and what I found wasn’t what the marketing promised.

Why this matters

Cryptocurrency scams and misleading platforms are a real, growing problem. In 2024 and into 2025, on-chain scams and pig-butchering-style operations surged, with industry research estimating scam revenue in the billions. Chainalysis and the FTC documented large increases in crypto-related fraud and consumer losses, so a cautious, evidence-based look at any platform is worth your time.

Key takeaway: Treat new crypto platforms like unknown restaurants read the menu, check the reviews, and verify there’s actually a kitchen.

What is crypto-legacy.app? (claim vs reality)

Many pages describing crypto-legacy.app present it as a full platform for buying, selling, and managing crypto with automated trading, portfolio dashboards, and “market integration” features. The site itself contains blog posts and platform-style marketing language that imply such features exist.

But here’s the gap: there’s no clear evidence of a downloadable app, a secured trading interface, or independent audits on the public pages I checked. Several third-party review posts repeat claims that the platform is a trading app, yet deeper inspection shows mostly blog posts, marketing pages, and promotional content rather than verifiable product features.

Table Claim vs Evidence (quick view)

| Claimed Feature | Evidence on site | Third-party verification |

|---|---|---|

| Buy/sell crypto via platform | Marketing copy & posts | No public dashboard or demo found. |

| Automated trading bots | Article mentions features | No audit report, no vendor whitepaper available publicly. |

| Portfolio management | Blog posts discussing portfolios | No clear screenshots, API docs, or app download links. |

| Privacy & policy | Privacy Policy page exists | Policy present, but not proof of regulatory compliance. |

Key takeaway: The site looks like a content-driven blog dressed as a product. Marketing language ≠ functional product.

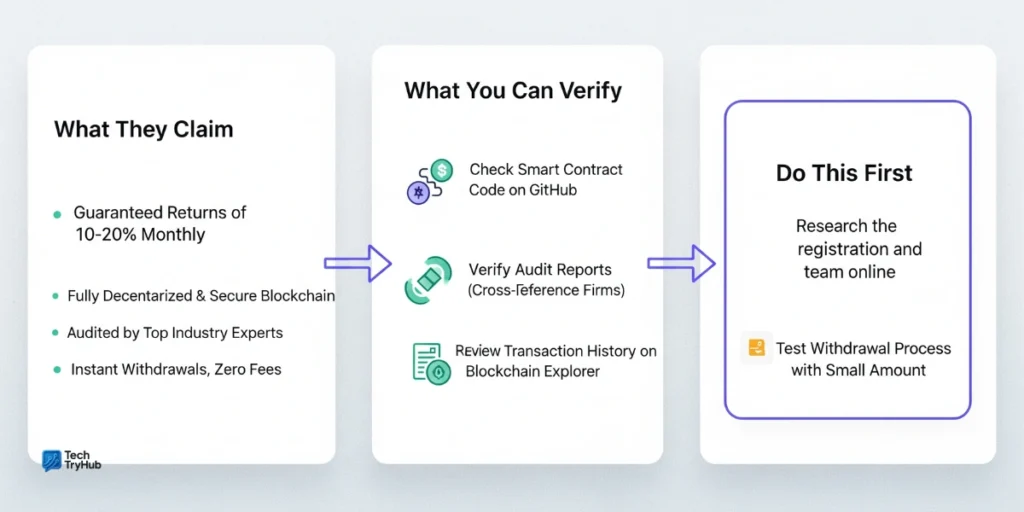

Is crypto-legacy.app safe? (red flags and verification checklist)

Short answer: Not proven safe. Here’s what I checked and what you should look for before trusting it or any similar site with money.

Red flags I found

- Marketing language without product access. Lots of “we do X” copy, little to no functional access (no demo, no clear app download, no dashboard screenshots).

- No independent audits or security attestations. Reliable crypto platforms usually publish security audits (e.g., smart contract audits, penetration tests). I couldn’t find any.

- Third-party coverage is thin and promotional. Several reviews echo marketing claims without fresh investigative evidence.

- Domain style can mislead. The “.app” TLD and product-style names often create implicit trust; attackers exploit that trust. Industry reports show scammers increasingly exploit professional-looking domains to impersonate services.

Quick verification checklist (do this before depositing funds)

- Can you create an account and view a real dashboard without depositing? If not be suspicious.

- Is there a professional audit (PDF) from a known auditor (e.g., Certik, Quantstamp)? Yes If not risk rises.

- Are the team members publicly verifiable (LinkedIn, press mentions, regulatory filings)? Yes If anonymous extra caution.

- Does the site have transparent fees, legal entity details, or a public terms and AML/KYC policy? Yes Partial presence of a privacy policy is not enough.

Key takeaway: If a site looks like it’s selling a platform but doesn’t let you inspect the platform, treat it as untrusted.

The wider landscape: why crypto-related scams are surging

You’re not paranoid the risk is real and rising. Industry trackers and consumer agencies have shown a worrying trend:

- Chainalysis estimated crypto-scam revenue near $10B+ in 2024 and highlighted evolving scam tactics that blend on-chain transactions with off-chain social engineering.

- The FTC reported steep increases in losses tied to crypto and payment scams; investment scams were a top loss category in 2024.

- News investigations point out that bad actors increasingly use AI and polished web design to make scams convincing. Reuters documented how AI tools were used to scale deceptive operations in 2025.

Mini story: I once followed up on a shiny “AI trading” offering and found the site’s blog full of high-energy claims but zero product screenshots. A quick search found several other blog posts copying the same promotional language classic content amplification, not product proof.

Key takeaway: Scammers have scaled their operations; polished websites are not proof of legitimacy.

How to evaluate platforms like crypto-legacy.app (step-by-step)

If you’re curious about a new crypto platform, take these practical steps I use them myself.

- Search for independent audits and security reports. If they publish audits, download them and check the auditor’s domain and date.

- Look for verifiable business details. Registered company name, address, regulatory registrations (if they handle fiat), and real team profiles.

- Find real user evidence. Screenshots are easy to fake prefer transaction hashes, verified GitHub repos, or community thread screenshots with timestamps.

- Ask for a demo or trial mode. Reputable services will let you explore without risking funds.

- Check domain age and backlink profile. New domains with a small backlink footprint are riskier.

- Search security news. See if Chainalysis, CoinDesk, or security blogs have flagged the site.

Key takeaway: Treat verification like due diligence on a bank slow and methodical.

Case study how a misleading site can confuse users (realistic example)

I want to share a quick example to make this concrete.

“A friend thought a site called ‘SmartCryptoApp’ was an exchange because its homepage had buy/sell buttons in images and glowing testimonials. She deposited $500 after reading a third-party post that praised the platform. There was no audit, and the ‘testimonials’ disappeared after a week. Recovery was impossible. She learned the hard way: screenshots and blog posts aren’t proof.”

This kind of story matches what Chainalysis and the FTC warn about: social engineering, polished marketing and rapid escalation of losses.

Key takeaway: If there’s pressure to act fast and you can’t verify the product, step back.

Practical alternatives & safer options (if you want similar functionality)

If you were attracted to crypto-legacy.app because you want automated trading, portfolio dashboards, or simple buy/sell flow, consider established options with audits and regulatory footprints:

- Top exchanges with audit trails and large liquidity (Coinbase, Kraken, Binance check local availability and regulation).

- Reputable automated trading platforms with public audits and community reviews (e.g., 3Commas, Zignaly always verify current audits).

- Self-custody + vetted bots run an audited bot on a separate account with low funds first.

External resources for safety tips: CoinDesk’s scam guides and the FTC’s consumer alerts are practical reads.

Key takeaway: Choose platforms that provide verifiable, third-party proof and allow you to test without large deposits.

A short, actionable “If you already used the site” checklist

If you already gave funds or personal data to crypto-legacy.app, do this now:

- Stop further payments. Immediately.

- If you shared private keys, assume compromise. Move unaffected funds to a new, secure wallet you control.

- Change passwords and enable 2FA on any linked accounts.

- Document all communications and screenshots; contact your payment provider and report to authorities (local law enforcement and consumer protection bodies).

- Report to the FTC / consumer agencies and file reports with crypto intelligence firms if possible.

Key takeaway: Quick action reduces further exposure, but recovery is often difficult prevention is better.

Quote from experts & authoritative sources

“Scammers are increasingly professional polished sites and AI-generated content make fraud more convincing. Always verify audits, company registration, and third-party coverage before funding a new crypto service.” paraphrase of Chainalysis & FTC findings

Key takeaway: Trust but verify and when dealing with money, verification should come first.

Conclusion

Here’s the bottom line: crypto-legacy.app reads like a site dressed as a service. It contains marketing copy and blog posts, but public proof of a working, audited trading product is lacking. Given the current surge in crypto scams documented by Chainalysis and the FTC, that gap matters.

If you’re thinking of testing a platform: don’t rush. Verify audits, try a demo account, and only risk what you can afford to lose. If you found this helpful, share the article with a friend and check our other guides for vetted tools and safer alternatives.

Your next step: Bookmark this guide, use the verification checklist before depositing, and subscribe for monthly updates on suspicious sites and trustworthy tools.

👉 Your financial safety is worth a five-minute verification do it now and sleep better tonight.

FAQs

Q1: What is crypto-legacy.app?

crypto-legacy.app is a website that presents crypto-related articles and marketing-style pages claiming platform features. However, public evidence of a downloadable app, trading dashboard, or independent audits is limited.

Q2: Is crypto-legacy.app a scam?

There’s no definitive public proof that it’s a fraudulent operation, but significant verification gaps and promotional language without product access are red flags treat it cautiously.

Q3: How can I check if a crypto app is legit?

Look for independent audits, company registration, verifiable team profiles, test/demo access, and reputable third-party coverage (Chainalysis, CoinDesk, FTC guidance are good starting points).

Q4: I deposited money what should I do?

Stop further transfers, change passwords, enable 2FA, document communications, and report to your payment provider and consumer protection agencies (FTC or local law enforcement).

Q5: Are polished websites proof of a real crypto product?

No. Scammers now use professional design and AI to create convincing sites. Always verify technical proof (audits, transaction records).

Q6: How do I verify a crypto trading bot’s audit?

Ask for the audit PDF, confirm the auditor (e.g., CertiK) via their site, check dates, and look for reproduced vulnerabilities answered by the platform. If the audit can’t be found or verified, assume higher risk.

Q7: Can I recover funds lost to a platform like crypto-legacy.app?

Recovery is difficult. Report immediately, gather evidence, and contact your payment provider sometimes chargebacks work for fiat transfers, but crypto transactions are often irreversible.